😇 Angel interview #17: Maia Bittner

"Ask founders who else has invested in them and look at who else is on the cap table because then that's a good enough reason to reach out to someone and share deal flow."

All the Angels is a newsletter about angel investing. By subscribing, you will receive an interview with an angel investor in your inbox every two weeks to learn about their motivations, their process, and their experience.

If you’re reading this but haven’t subscribed, join other angel investors, venture investors, and founders by subscribing here.

Here’s today’s edition:

🔍 Interview with Maia Bittner, fintech investor & previous founder

📚 Reading corner

Let’s dive right in!

🔍 Interview with Maia Bittner, fintech investor & previous founder

Maia is a serial founder. She founded Rocksbox, a subscription jewelry start-up, in 2012 and Pinch, a company focused on helping Americans build credit while paying rent in 2016. Pinch was acquired by Chime in 2018. She currently serves as the voice of the member at Chime. She is also active on Twitter and is a well-known angel investor in the fintech community.

Can you give a quick introduction of yourself?

I'm an entrepreneur by background. I started a company called Rocksbox in 2012. It's a subscription company. It was from working on a subscription company that I got an intimate understanding of Americans’ finances, and I knew I wanted to work on that.

In 2016, I started a company called Pinch. We didn't know what product we wanted to build, we knew our mission: we wanted to do something to help Americans become more financially stable. We ended up building a financial inclusion company where we focused on reporting rent payments to the credit bureaus to help consumers build their credit scores as they pay their rent. It was a great product, people really loved it, but it didn't have a venture-scale business model. We sold it to Chime in the summer of 2018. I now work full-time at Chime. I invest and advise early-stage startups on the side. I started investing in 2016 through the Sequoia scouts program.

Since you're a founder and you’ve been on the other side, what was your experience raising capital?

At my first company, Rocksbox, I was the CTO and my co-founder, Meg, was the CEO. She did most of the fundraising. A couple of my friends invested, including my good friend Michael Ducker, who later became my co-founder at Pinch.

For pinch, our round was led by Homebrew, Collaborative was the other fund in the round. The rest of the round was angels. It was a lot of people that my co-founder had worked with before, or, angels that we met in the course of fundraising.

As a founder, what was the difference between the relationship you had with an angel versus with a venture capital firm?

The relationship with angels is super all over the place. There were a lot of people whom we met, shared what we were doing, they wired us money and we never heard from them again.

We sent out monthly updates. That's what every founder is supposed to do. Now that I've been investing, I realized that most founders don't do that and I miss it! It’s common advice but sending a monthly update is really much better. In the monthly update, we would try to include “here's our ask”. Different angels would be more or less responsive to that.

I don't know that our relationship with angels was categorically different from our relationship with the funds that had invested in us. Our relationship with our lead investor was different - We met with Homebrew every two weeks while we didn't have a standing meeting with any of our angels. Jake Gibson was definitely our most helpful angel: he was the only investor that actually used the product himself. He was intimately involved in reporting bugs, which is super, super, super awesome - and went to bat for us when we went out to raise our second round of funding.

Is using the product something you would recommend to angel investors?

It depends on your goals with angel investing. There's a whole thing about value-add investors. I try to be helpful in part because I've been on the other side of it, and I know how helpful it is to have angels that work for you.

Angel investing sucks up a huge amount of time. If you're not excited about committing a lot of time, what happens is that you are going to disproportionately invest in bad companies. Sorry to be frank but it’s the truth. If you reply to your emails within 10 minutes, nobody is going to kick you out for not replying. But if it takes you a couple of days to reply to your emails, the best companies are going to tell you sorry, we can't wait for you because we’ve reached our allocation. But the worst companies are going to be like, “No, we still want your money” because they can't raise from anyone else.

If you can't put a lot of time into it, you end up only investing in bad companies. That's a hard position to be in but it’s not necessarily related to you using the product or not soI wouldn't say definitely use the product or don't use a product. Figure out your strategy: if you want to put in a bunch of time, providing value to founders is a great way to do that but I wouldn't recommend using the product over being a world-class communicator and replying quickly to emails of founders that you like.

If you're not excited about committing a lot of time, what happens is that you are going to disproportionately invest in bad companies. Sorry to be frank but it’s the truth.

What you're alluding to is how to get into rounds. To get into rounds, you need good deal flow. How do you find deal flow?

Most of my deal flow comes from Twitter. I'm pretty prominent on Twitter and people reach out and pitch me on Twitter.

Most of the companies I invest in aren’t from Twitter, though. Most of them are from friends in the industry. The way you do that is you show up at networking events, you talk to people, you reply to your emails quickly, you make it known that you’re investing, you make it known you want to meet other early-stage investors doing deals.

You give people an understanding of your brand. When people think of FinTech, they often think of me because I've built a brand there. If you don't really know what type of companies you like, it's going to be hard for people to think of you when they’re trying to fill out a round - everyone says they like “good companies” but we all have different attributes that make a company seem good. Be clear on what yours are and broadcast what you like widely

Coming up with a tight investment thesis will help you get the deal flow that you're interested in. The other thing is that it snowballs: it takes a long time, which can be frustrating for people, but it does work.

There is this person who probably sends me some of the best deals and the way that we got connected is that he saw me on the cap table of a company that he invested in, and he reached out saying “Hey, saw that you invested in the same company as me, and would love to learn more about you.” It takes a long time because I had to make that investment to make that connection. But that's not that crazy. Quite often, looking at your cap table and seeing who you invest with is quite interesting.

You give people an understanding of your brand. When people think of FinTech, they often think of me because I've built a brand there.

I like that tip.

That's a number one tip. Ask founders who else has invested in them and look at who else is on the cap table because then that's a good enough reason to reach out to someone and share deal flow.

Going back to Twitter, that's how you get deal flow. You have a good Twitter presence, you have a brand, you seem comfortable with it. Someone told me for investing & venture, Twitter is table stakes. What’s your advice for people getting started on having a Twitter brand?

That’s a good question. I live and breathe Twitter, it’s a big part of my life. I have a brand. I'm known for stuff but it's very authentic. I'm not trying to create a brand.

I get the question of “do I have to be on Twitter?” a lot, especially from founders. My answer is always “No”. My answer, I stole this from Hunter Walk but I like it and I've adopted it, is if being on Twitter, writing blog posts, or having a newsletter, if that's the type of thing that gives you energy, then you should do it and you should invest in that.

There are some people who say founders shouldn't be investors because it's distracting them from building the company. My answer is the same there. If that's something that gives you energy, you should do it. Because if you have more energy, you can funnel that into all the other pieces of being a good investor

For me, posting on Twitter gives me energy. It's not a distraction and I'm happy to invest in it, it’s worked really well. There are a lot of people for whom it doesn't give them energy, it just costs them energy. For them, don't force it. Focus on the things that do give you energy.

There are a lot of communities that you can build outside of Twitter. I just started this FinTech book club, there are also networking events, there are podcasts, etc. There are so many ways to get out there. One of the favorite people I follow on Twitter right now is Jomayra. She's at Cowboy Ventures, she is just awesome and it's been so cool following her.

Founders definitely do not have to be on Twitter. Most of the founders I've invested in are not on Twitter. With investors, it's more important as it’s a good way to get my name out there and have people know about me but I don't think it's required.

For me, posting on Twitter gives me energy. It's not a distraction and I'm happy to invest in it, it’s worked really well. There are a lot of people for whom it doesn't give them energy, it just costs them energy. For them, don't force it.

Yeah. It also sounds like the more important thing is authenticity.

100%

What have your biggest learnings from angel investing and what are some milestones after investing for 1 year, 2 years, etc.?

One of the things that I went through two years in, was that I thought that I was a terrible investor. There's a phrase: lemons ripen early. Companies that don't work out, you find that out early. Out of all the companies I've invested in, 50% of them, I don't know what they're doing and 50% of them are dead. It's like, this seems terrible. But that's how it goes.

Of the 50% that I didn’t know where they stood, they're doing much better. It just takes a long time to do well, while you can fail immediately. That was hard for me. Everybody says that it takes 10 years to know if you're a good investor or not. You might know this intellectually but secretly, I was worried that I was a terrible investor. It’s hard to find the appropriate timeframe to gather the data to know how your investments are doing.

Especially with a background as a founder or operator, you’re used to getting an immediate signal. Waiting a long time for a signal can be a hard transition. What type of investments have you made?

I like companies that make healthcare, education, transportation, and housing more accessible for Americans and that often overlaps with FinTech, but not always. I invested in this fancy commuter shuttle bus company because it makes transportation more accessible. That doesn't have anything to do with FinTech except that they sell tickets to the bus.

I like entrepreneurship, my background is in entrepreneurship. It's a really satisfying way to support your life and to make money. I like anything that is lowering the barriers for other people to become entrepreneurs. This new class of micro-entrepreneurs like Twitch streamers and Instagram influencers and tools that support them is something that I'm super excited about.

I do a lot of FinTech infrastructure. I invested in compliance management software and ACH fraud detection software, a lot of things that are running in the back-end of FinTech.

What was your last announced angel investment and what made you decide to invest?

I'm investing in Bloom Credit, an API that helps people read and write data from the credit bureaus. It's both pulling credit score information as well as reporting information on people and their liabilities. At Pinch, we built our own integration with the credit bureaus and it was extremely painful tactically to format the files: they're a fixed-width file format from the ‘70s you upload over an FTP site to the credit bureaus. They also don't do any kind of tokenization.

You're uploading all of someone's personally identifiable information (PII) every time you report payment activity for them, including their social security number, birthday address, full name, all of that. It's a crazy system. Working with the credit bureaus, I'm surprised people's data doesn't get leaked more often because of inherently poor design. Also getting a relationship with the credit bureaus is really hard and what Bloom has done is streamlined the process.

You still have to apply, not anybody can sign up, but they've modernized and streamlined the process so that it takes you a couple of days instead of weeks or months to get a relationship with the credit bureaus. They also provide software that does the data sharing: you get to interact with a slick modern API instead of a clunky fixed SFTP file system.

I think that it's perfect timing: not only is FinTech really hot right now, but credit building is specifically quite hot. Investing in the picks and shovels for that industry is awesome. Plus I've known the founder Matt Harris for years and he’s awesome.

With your experience within FinTech, what are some trends that you are interested in?

I love the “buy now, pay later” stuff that matches up to the first wave of making people get paid more often. McDonald's pays people daily, Uber pays people seven times a day. People are getting paid much more frequently, but their expenses are happening at the same cadence. The introduction of the “buy now, pay later” companies like Affirm and Klarna, are matching revenues to expenses. This makes it easier to manage your cash flow.

With Pinch, we were focused on rent payment. I think that bill payment broadly, and affording your rent specifically, is painful for people. I don't know what the right solution is there. I tried to start a company to fix it and wasn't able to. I think there's still a ton of opportunity there, in particular as housing prices have gotten so expensive.

Airbnb ended up being rich people becoming part-time hoteliers on the side. I wonder if there was a better way for people to subsidize the cost of their housing by making it easier and more dynamic to get roommates. What if you had an extra bedroom and somebody could stay there for a month? Just like how Uber helped people increase their income by basically liquidating the value of their cars. They have all this value locked up in their cars, Uber lets you pull some of that out. I feel like housing could be the same way: people have a lot of value locked up in their housing, and they can't quite afford it but if you could let them rent a room for a week and let my housing work for me, that could help.

What returns do you expect from your angel investing portfolio?

I have no idea. I have companies that I invested in and I thought they were dead, then they come out of nowhere and raise a bunch of money. It's hard to predict. A big reason I invest is that I love learning, and I’ve already learned a ton. So even if I never have any returns, I actually feel like I’ve gotten a wildly valuable education for not that much investment.

I don't think I have any returns so far. Some of the companies I’ve invested in have been acquired by other companies. So I have stock in that company and now I have stock in this other company where I’ve never even met the founders, and I hope that works out.

A big reason I invest is that I love learning, and I’ve already learned a ton. So even if I never have any returns, I actually feel like I’ve gotten a wildly valuable education for not that much investment.

Do you ever get added on the new company’s investor updates afterward?

Sometimes, I do. I have different stocks in companies. I have some companies that died and gave half the money back. It's realized, but uh, doesn't really count as returns.

Out of all of your investments, how many of them have had follow-on rounds?

I have all those stats in like a spreadsheet and, frankly, my conclusion is that shit takes a long time, like I just had a company launch on Product Hunt that I invested in over two years ago.

I'm nervous about putting too many numbers to mark-ups because 1. I haven't done all the dilution calculations and 2. I was investing in seed and some of these companies are only now raising a Series A. In the last year or two, I've started participating in A rounds. Now, I hope in 2-4 years, the companies I’m investing in will have B and C rounds. That'll be more interesting.

You mentioned that you're part of the Sequoia scout program. What are the advantages or disadvantages of joining a scout program? Is that something you would recommend for people?

I would not be an angel investor without Sequoia. I owe everything to them. They took a chance on me in 2016, and they’re still taking a chance on me. It's not like I'd been some amazing investor with any track record before Sequoia.

Being part of a scout program, I didn't have any money to invest in startups. Being part of that scout program gives me training wheels to learn how to codify formal relationships with startups when I meet companies that are really exciting, how do I ask them can I put money behind you?

It seems like everybody's trying to get a scout position. I see a lot of people who are like “I want to be a scout: I'm very smart, and very great, I've gotten all A+ on my GPA” That's what their life and career have been historically. It's funny because you can tell that these people who are trying to get scout positions are not entrepreneurs. An entrepreneur would never be like, “I'm amazing. Give me something great”. Entrepreneurs are fucking doing sales, they know how to sell. Anybody who knows how to sell will not be like “But I have really good deal flow. Can I be a scout?” People who know how to sell are pitching VCs on how they’ll share the advantages to the VC, the benefit the VC will get, what outcomes they might expect.

It’s funny because you see all these people from big companies who are like “I would like to be a scout now. Please, can you anoint me?” You need to hustle for it. It's very popular for people to talk about scouts right now -- frankly, I actually think part of the reason is because it has a cute name.

Fundamentally, this kind of dynamic where VC firms have rewarded people who bring them good deals has existed forever, it just didn't have a cute name attached. Now everyone's like, I want the cute name. Just do the work first. I think Sequoia was one of the first to formalize it into a “scout” program but lots of venture funds do this.

What’s interesting is that you mentioned the scout fund provided you the cash flow to invest in companies.

That's how Sequoia works but all the scout programs take on different forms.

How do you expect investing will change in the next 5 years?

It's become more democratic both culturally and by law. The SEC just changed the accreditation rules so that you can become accredited with education, not just with cash. There are also more opportunities for crowd-funding now. I think it's interesting, though I think a bunch of people might get burned.

I’ve been talking to some hedge fund people who want to get into investing in private companies. I'm like: “I hope you understand what it means to invest in a private company, which is that it likely goes to zero”. Even if it's doing well, you can't get your money out, there's no liquidity.

It sounds like you’re saying that there are going to be a lot of new actors, because of the lower barrier to entry but not everyone will necessarily be prepared.

It's good that more people are involved in it. In the long run, it'll be way better for everyone. The rewards from being able to invest in technology companies you believe in earlier is definitely the step in the right direction. Right now, those investing are concentrated mostly in just people who are already rich get richer. In the short term, while we get to this better future, we might stumble.

What's the number one piece of advice you want to share with aspiring female angel investors?

I have the same advice to everyone in all situations, which is to really interrogate why you think you want to do something.

If you want to be an investor, why is that? Be brutally honest with yourself. If you want to be an investor because that seems cool and investors have lots of followers on Twitter, that's fine. Are you really clear about your goals?

Digging into “I want to be an investor”, what does that mean to you? Does that mean spending lots of time with early-stage companies? Does that mean that you think it's the best way to get rich? Does it mean you think your friends are gonna think you're cool? Whatever it is, figure that out. That's going to help shape your path to get there. There are so many different ways that being an investor can look like.

My #1 advice is always to be really clear about exactly what you want and the trade-offs, what doesn't matter to you, and be prepared to sacrifice big amounts of stuff you've intentionally decided is not a goal. You're just going to get better and faster when you’re honest with yourself about what you’re trying to achieve.

If you know what you want, you can describe it to people to help you get there.

If you want to be an investor, why is that? Be brutally honest with yourself. If you want to be an investor because that seems cool and investors have lots of followers on Twitter, that's fine. Are you really clear about your goals?

It goes back to what you were saying about when someone reaches out to you, you say I want to invest in FinTech and now people know what you want, and they can give it to you if you're specific.

Exactly. It's very hard for people to give you or help you with what you want without you being clear and specific on the ask to yourself.

Last question, Where can people follow you?

They can follow me on Twitter @maiab. My DMs are open, though I might not always respond.

📚 Reading corner

How to be an angel investor in early stage startups when you don’t have any money by Maia Bittner

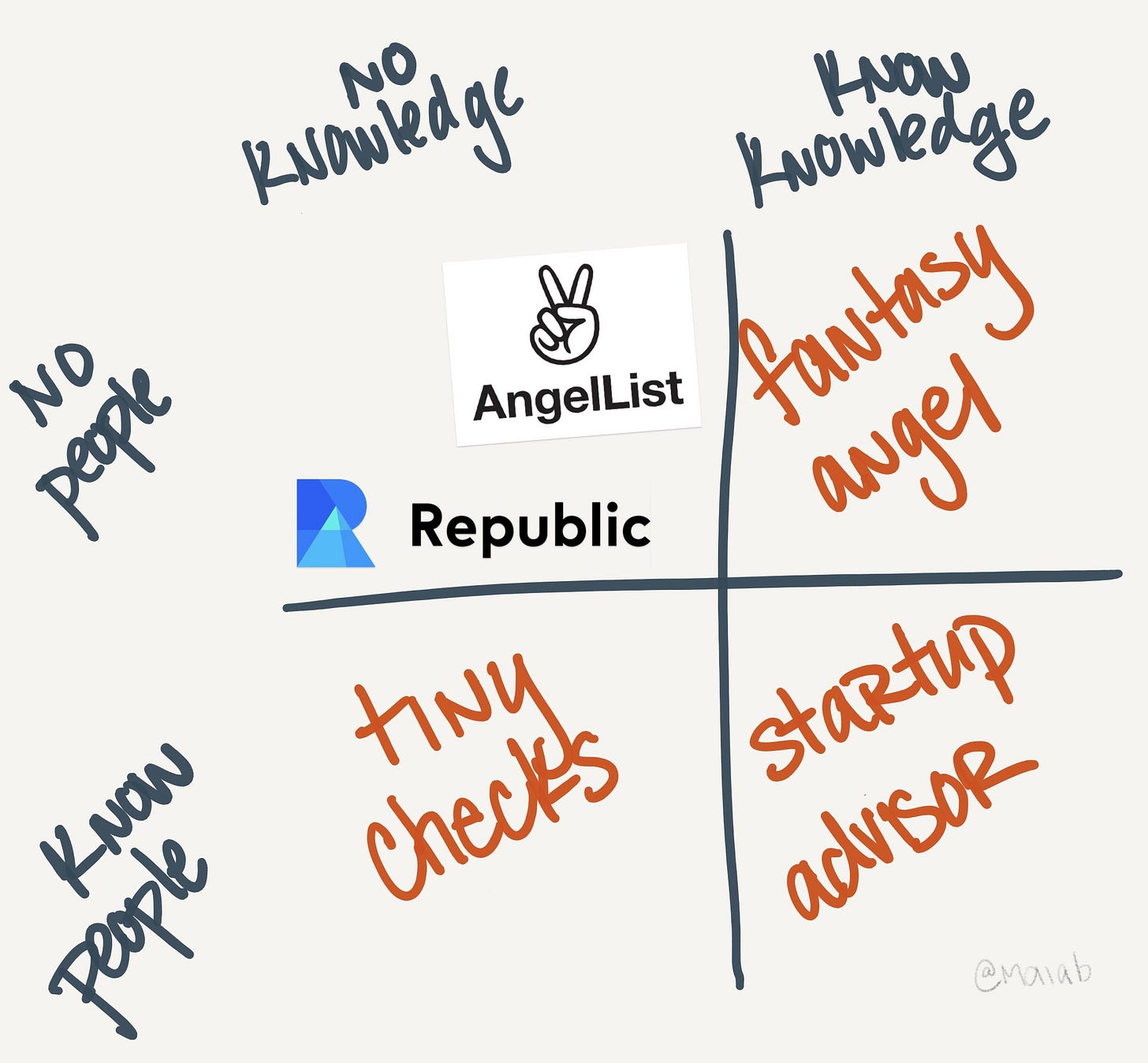

Maia provides a helpful framework for what to focus on when first angel investing but not having the ability to write big checks. She breaks it down by two axes: 1. having special knowledge and 2. knowing the right people.

Three Types Of Startup Advisors You Might Not Have Thought About (But Will Help You Win) by Hunter Walk

This article was written for an audience of founders but I still think it can provide value to those thinking about becoming investors. How might you provide the value-add that will convince a founder to take your check over someone else’s? The three types of investors you could be:

1. Invest in a company that you want to keep track of and potentially work at down the line (and they would be delighted to have you),

2. Invest in a company where you can provide mentorship to the founder’s team,

3. Leverage your industry expertise and help the company with customer feedback (e.g. if you work are a developer, you can give feedback to the founder of a DevOps tool)

Angel Investments vs. Stocks: A Practical Guide by Yun-Fang Juan

Yun-Fang comes back with another helpful guide. Since I regularly get the question from all of you about whether to invest in the public markets or in start-up equity, I thought this was a particularly relevant article.

The biggest difference between public markets and start-up equity is the illiquidity of angel investing: “I just had the first IPO announcement from my portfolio after 9 years. Matterport is actually my very first angel investment. It’s going to return about 40X but I had to wait for 9 years with a lot of ups and downs in between.”