😇 Angel interview #16: Jessica Meher

"Angel investors are followers: we trust other angels who are investing in the right people. If you can lean on others, you're reducing more risk than you might be aware of."

I made it to Texas on Sunday night just in time for the winter storm and lost power for more than 36 hours... I have to say getting this newsletter out this week was a bit of a challenge. I’ve also started learning more about power grids and “winterizing” gas and coal plants. I hope all of those of you who might have gone through the same thing are safe and doing well…

—

All the Angels is a newsletter about angel investing. By subscribing, you will receive an interview with an angel investor in your inbox every two weeks to learn about their motivations, their process, and their experience.

If you’re reading this but haven’t subscribed, join other angel investors, venture investors, and founders by subscribing here.

Here’s today’s edition:

🔍 Interview with Jessica Meher, CEO of Wonderment and founder of Girl Capital

🔥 Rapid-fire interview with Amy Yin, CEO & founder of OfficeTogether

👓 Feedback from inaugural All the Angels community event 2/11

🔍 Interview with Jessica Meher, CEO of Wonderment and founder of Girl Capital

Today, you’ll learn from Jessica:

How she learned about angel investing by being an operator at a growing venture-backed start-up

How she originally thought being an accredited investor meant she had to pass some test

How it’s important to tell the world you’re investing prior to making that first check

Jessica is a startup founder, angel investor, advisor, and results-driven marketing leader. She currently serves as CEO of Wonderment, a post-purchase experience platform for DTC brands, which she founded in 2020. Prior to that, she served as an advisor to startups in both Techstars and 500 Startups, and founded Girl Capital in 2015, a platform for aspiring female investors to discover and learn the world of seed investing. Jessica also has roots with some of Boston's highest performing companies, working as the Head of Enterprise Marketing at HubSpot and as Vice President of Marketing at InVision.

Can you give me a quick introduction of yourself?

I'm Jessica Meher, co-founder, and CEO of Wonderment, a SaaS company in the e-commerce space. I’m also an angel investor and founder of a community called Girl Capital. I’m super passionate about startups, helping diverse founders and execs succeed, and coaching and mentoring others.

Tell me a little bit more about how you started angel investing. How did you first hear about it?

I always had an interest in the venture side. I have been fortunate to have met a lot of folks in venture capital through working at HubSpot. We were growing really fast and I was always curious about what went into that. It started with me asking a lot of questions. Over time, I realized there was a whole segment of investors called angel investors. For the longest time, I wondered about how to become an angel investor. It seemed like such a black box as if only the successful entrepreneurs who had big exits became angel investors.

I just wanted to know, how do I go from where I was to become an angel investor? I started asking a lot of questions, doing research online, and I actually found it overwhelming. I still couldn't understand. How do I get to that point? What makes a valuable angel investor? Do I have to apply somewhere to become an angel investor? What is that whole process?

Over time, in 2015, I discovered a program called Female Funders, from an amazing woman based out of Canada. She started this initiative to get 1,000 women to write their first angel investment check. She developed a course online that I took. Through that program, she also created a fund where she had startups participate in the fund, and got 25 women to write their first $1,000 check. We collectively raised $25,000, to invest in a startup through her program. That was the very first angel check that I ever wrote. $1,000. That's all it took. That's how I guess learning how to get started and how I made my first investment.

I'm thankful for that program. There are actually a lot more programs like that nowadays. At the time, I didn't feel like there were a lot of programs.

For the longest time, I wondered about how to become an angel investor. It seemed like such a black box as if only the successful entrepreneurs who had big exits became angel investors.

Can you tell me a little bit more about the company you invested in?

The company is a eSports and gaming analytics platform. It was started by a woman CEO. That's the other thing that I loved about their program, they only had female-led companies come into the program. It's very important to me that if I'm going to be an angel investor, I also want to support other women and diverse founders.

I knew nothing about eSports but what that whole course taught us is how to do due diligence. Even if you don't know anything about the category, we learned how to look at it, how to assess it, how to assess the person, as well as the market and the opportunity and the technology. We did that all together. We collectively talked about the company and then made a decision on the particular startup that we were going to invest in.

That's awesome. Do you know how the company is doing now?

The last that I've seen, they have a product in the market, they have customers and are growing. Because I invested in this so long ago through a fund, I don’t get investor updates directly, but I am following them.

That's one disadvantage you have to be aware of: if you're an angel investor and you're investing in part of a fund, sometimes you're not privy to all of the investor updates, and you have to ask for it. Some start-up founders are better than others at giving updates.

How many investments have you made since 2015?

I've probably done 12. Out of all of them, most of them were $10K or less. I've done two follow-ons after the initial investment. Most of my investments are on the smaller side. I consider myself to be a micro angel. That was one thing that I had a difficult time overcoming: there was a lot of advice out there that said that you're only really a valuable angel if you're writing checks of $25K or more. I was not ready to make that large of an investment. There's another piece of advice that says that you want to make at least 10 investments. So if you want to diversify your portfolio, and I would have needed to make ten $25k investments, something I wasn't willing to do.

I started small, and that's how I learned. You go into being an angel investor, knowing that you're probably gonna lose a lot of money because most startups fail. I did it really to learn and I'm hoping that I have a good outcome from it. My point is that I want to learn and I want to teach other people to angel invest. And that's why I do it.

I started small. You go into being an angel investor, knowing that you're probably gonna lose a lot of money because most startups fail. I did it really to learn […]

How much time in a week do you spend on angel investing? How do you balance that with being a founder?

As a founder, I don't have as much time as I used to. I only make a couple of investments per year. Of those investments, I want to spend a lot of time with the founder because I want to be helpful. Most of the time, I'm not just writing a check. With certain founders, I'm way more involved in terms of how I can help them: referring them to talent, doing brainstorming meetings with them, etc. I only pick the opportunities where I feel passionate to dedicate my time. I'm not a full-time angel investor, I do it on the side.

What's your superpower as an angel?

My background is leading marketing at high-growth SaaS companies. Most of my investments are purely SaaS software. I only invest in what I know. I know a lot about go-to-market, that's where a lot of start-ups need my help typically, because they're either product-led, or they don't have a marketing background. I'll also help with hiring and management.

What's an example of what you've done to support a founder?

It's case by case. Some founders will email me a question and I'll write back, helping them in any way I can. I don't do anything tactically, just because I don't have the time for it. It's more of "Here's what you should know. Here are the goals you should focus on. Here's the type of person you should hire for this role."

It's almost as if I'm coming in as an advisor to help them think about all the different ways that can go-to-market and how to think about tying that back into the milestones that they want to achieve as a company. I help them keep super focused. Especially in marketing, there are so many different things you can do and there are so many distractions. Startups think that they need to be everywhere all the time and that's not the case.

What have been your biggest learnings from angel investing? If you were to give advice to Jessica that was just getting started in angel investing, what would it be?

I wish that I got involved earlier. It comes down to a competence issue that I'm not qualified to be an investor. Whereas you can just focus on what you know and go for it.

The other thing is to make sure you can invest your own capital. You need to make sure that you can make the financial investment, that you're comfortable because you don't want to be making too many investments and then putting yourself at financial risk.

The biggest challenge that I had starting as an angel investor, if you're ready to write your first check, you can't just say, "Okay, everyone, I'm ready. Now, here's my check". At that point, you have no deal flow. I wish I had started working on deal flow earlier to let founders know that I was planning to be an angel investor. I plan on writing checks soon, keep me in mind as you go to raise your next round and reach out because I might want to invest. I was shy about it at first.

If I had more deal flow, there were opportunities that I missed out on that I wish I was a part of, because they didn't know that I was an angel investor. Once I knew I wanted to invest, I should have put it on my LinkedIn, put it on my Twitter that I'm an angel investor.

I've had the same conversations with aspiring female angel investors about letting the world know. They will say something similar if I suggest they let the world know that they’re angel investing: "Oh, but I'm not really angel investing". It goes back to your qualification. People feel like they need to be qualified to be an angel investor before they could start. But there is no exam that says you're now an angel investor.

In order to be technically qualified, you do have to be an accredited investor. When I heard of that, I thought there was an application. It's more the government telling you that you are financially capable to write checks. When I first started, I wondered "Oh, if I'm only starting by writing $1,000 checks, does that qualify me?"

I can't invest in every deal but I try to help, teach other angels about how to invest. I spent a lot of time moving deal flow around, I get a lot of inbound interest entrepreneurs who are raising around and they're looking to connect with more female angels. That's a lot of what I do now, even if I'm not investing a lot.

When I first started, I wondered "Oh, if I'm only starting by writing $1,000 checks, does that qualify me?"

Definitely, there's more than just writing a check when angel investing. You mentioned you made your last through TBD Angels. What was the investment and what made you decide to invest?

The company is called Qatch. They are the Netflix of shopping where they offer a personalized shopping experience over text message. I'm a huge fan of the industry in the sense that the way people are going to shop and buy things is going to change. I think shopping has become super overwhelming online, especially in the clothing industry. It's hard to discover new brands and clothing online.

I was attracted to the product and the mission, but also to the CEO and the founder, Nicole. She's amazing, a hustler, go-getter, problem solver. An amazing person who has made amazing progress since I've met her and where she is today. With TBD Angels, we were excited that we could collectively make an investment in the company. I believe in the purpose, the mission in the market, and most importantly, the CEO and the founding team.

Twitter has become an important part of being an angel investor. Do you have any advice for investors who are trying to build out their brand on Twitter?

I'm a big fan of Twitter, I joined in the early days of 2007. I've been using Twitter for a long time but in the last couple of years, it's become the de-facto platform for networking.

I don't think you have to be on Twitter. There are so many other ways you can network with people. A lot of my connections I got through working with TechStars. Twitter gives you a different kind of audience. It's a great audience, but it's only one part of it.

It’s super easy to connect with people and following people that you know you want to learn from and that you want to connect with. It's like speed dating on the B2B side. I encourage even folks on our team to up their Twitter game and to be more visible and public, just share and talk about things. Some people prefer to sit in the background and just learn and listen. And that's fine. But I think if you want to become more well known, you need that exposure, and Twitter's a really fast, easy, cheap way to do that.

[…] If you want to become more well known, you need that exposure, and Twitter's a really fast, easy, cheap way to do that.

What are some things that someone should do if they are starting to tweet?

One thing is just to be yourself. You don't need to come out seeming like you're an expert. In fact, if you try to do that, people will see through it. Just be yourself: share things that you like, have conversations, and jump in whenever you feel like you have something to add. Keep it really simple.

A lot of times, people don't have time to write a lot of content. You can sometimes just share articles and retweet. It's super easy. Also, be kind. I sometimes see people who are competitive, combative. That's not helpful. You can argue with people, you can have a different point of view but being helpful and being yourself, that's the perfect place to start.

That's good advice. What tools do you use for angel investing?

Google Sheets, Google Sheets, nothing very fancy.

I'm curious, what returns do you expect from your angel investment portfolio?

I don't know if I would [expect returns]. I expect zero returns and every angel investor should expect no returns. 95% (or some crazy high number) of startups fail. Obviously, if you're going to be an investor, you want to expect some kind of X percent return, but that doesn’t always happen. If I get a positive return from any angel investment, I'd be fortunate and very happy.

All of my angel investments are still relatively new. Even though I've been doing it for a few years, you have to wait 5-10 years for a liquidity event to happen. I'm still in that gray area where I don't know what's going to happen with some of these. We'll see, I've had one exit with very minimal returns. Calculating the return from an exit also gets confusing, because it depends on whether it's a cash deal or if you're getting stock in the new company. If you get stock in a new company after the start-up has been acquired, that's not cash in the bank.

What's the number one piece of advice you want to share with aspiring angel investors?

If you have the financial means and you're willing to write a $1,000 check or twenty $500 checks or whatever, just ask somebody about where you can make that investment and how to get started, just do it. Don't worry about all the legalities and the diligence and the paperwork, work with somebody who will do that for you. If you're looking to lead a deal for your first angel investment, that's a lot of work and it can be overwhelming. But if you're still interested, get involved with a fund or an angel group, somebody that you can tag along with and trust is making a good decision on the angel investment. A lot of times, angel investors are followers: we trust other angels who are investing in the right people. If you can lean on others, you're reducing more risk than you might be aware of.

A lot of times, angel investors are followers: we trust other angels who are investing in the right people. If you can lean on others, you're reducing more risk than you might be aware of.

Where can people follow you or reach out?

You can follow me on Twitter @JessicaMeher.

Which angel investor would you like to see interviewed for the next series? Feel free to share suggestions by responding to this email or leaving a comment.

🔥 Rapid-fire interview with Amy Yin, CEO and founder of OfficeTogether

Amy is the CEO and founder of OfficeTogether and recently finished fundraising (TechCrunch). OfficeTogether helps employees plan time in the office, see their teammates’ schedules, and take an automated health and symptom questionnaire that ensures that no one has a fever or has traveled in the last 14 days.

In this video, she shares what fundraising was like for her and what she looks for in angel investors.

Which founder would you like to see interviewed for the next series? Feel free to share suggestions by responding to this email or leaving a comment.

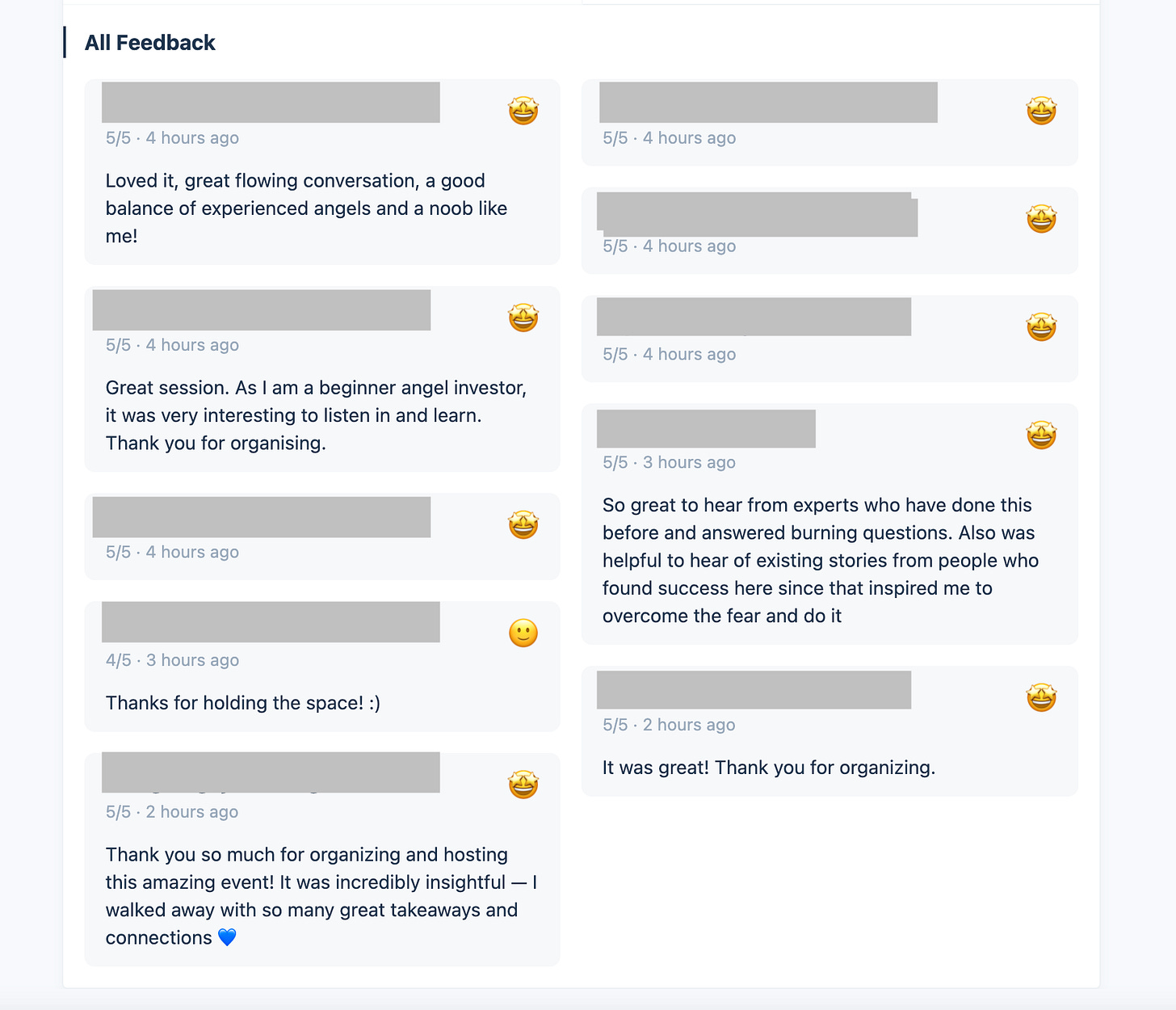

👓 Feedback from inaugural community event 2/11

We had our first community event last week and I cannot be more grateful to those who joined!

Results: I capped the event to ~50 people and had 24 people join the event. We had a 50% attendance rate, with a 4.9/5.0 rating.

We had angel investors from across the world, including the US, Germany, Mexico, UK. Everyone asked such great questions about the differences between direct and indirect investments and investing in founders internationally.

I was appreciative of all the positive feedback from those that attended.

I’ll try to organize another one this year and I think it’s great that we have a community that is open to helping each other.